Services

Investment ManagementInvestment Advisor in Birmingham, AL

Investment and Portfolio Management

When it comes to maximizing your wealth, it is crucial that you turn to a skilled advisor who knows the ins and outs of the industry.

McClellan Wealth Management has the experience and the insight to help you make smart investments. We can advise you on stocks, fixed-income investments, mutual funds, and more as part of our full-service investment management plan. We will help you develop and strengthen your investment portfolio to put you in a stable financial position and build confidence in your approach to investing.

As your trusted financial advising firm in Birmingham, AL, McClellan Wealth Management serves clients at all stages of life and with a vast array of different financial considerations. We first get to know them as individuals so we can tailor our investment strategies to their unique priorities and preferences. This is part of our overall commitment to providing unparalleled personalized service that is hard to come by in this business.

Types of Portfolios

Placing your trust

– and your financial assets – into the hands of another person can be difficult. But with our focus on personal attention and mutual trust, McClellan strives to act in your best interest and get you the results you are after.

Let us help you build and strengthen your investment potential through the following:

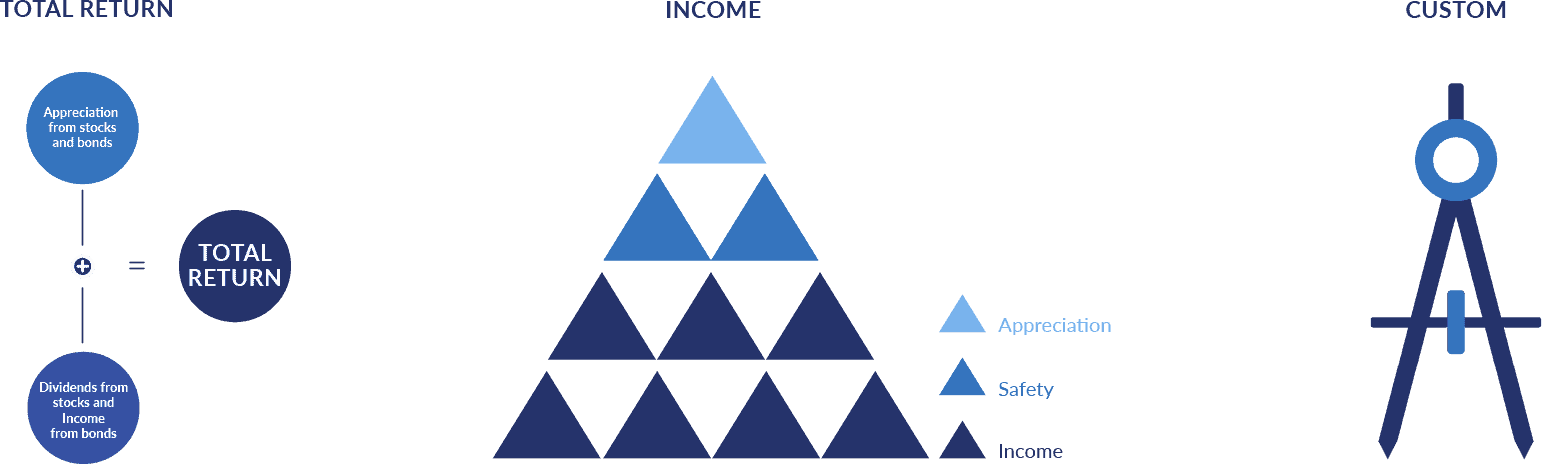

Income portfolios are generally used when a client is seeking more income than growth in their portfolio. Many times these are retirees and trust clients who are in a distribution phase of the investment lifespan.

Once we have determined what type of portfolio the client needs, we then use a highly specialized software to help us tailor the amount of risk the client can handle.

Total Return portfolios are mostly used when the client is in a long term growth mode of their investments. This is where we look for not only income producing positions, but positions that should have significant growth. Adding the “income component and growth component” gives you the “Total Return” type of portfolio.

Once we have determined what type of portfolio the client needs, we then use a highly specialized software to help us tailor the amount of risk the client can handle.

Custom Portfolios at McClellan are exactly as it sounds. We tailor portfolios to address specific needs. Some common needs include concentrated stock strategies, socially responsible investing and legacy asset divestitures.

Once we have determined what type of portfolio the client needs, we then use a highly specialized software to help us tailor the amount of risk the client can handle.

A Wise Investment

The first step toward creating a smart and rewarding investment portfolio of any kind is scheduling an appointment with McClellan Wealth Management. We will set aside a convenient time to give you our undivided attention and discuss the details of your current financial situation, your long-term goals, and your vision for the future. You will understand better how our services may enrich your life as you look toward a financially stable tomorrow.

Risk Management Software

Wealth Management

How do you plan for your financial future while enjoying the life you’re living today? McClellan Wealth Management has the perfect solution: Let us do the planning for you.

Financial Planning

It’s much easier to enjoy the day-to-day pleasures of life when you’re confident that the foundation of your future has been built on solid ground. That’s where financial planning from McClellan Wealth Management comes in.

Estate & Trust Planning

We believe financial security is just as much about planning for your legacy as it is about working to build and potentially safeguard your wealth in the present. And it’s much more fulfilling to spend your post-retirement years enjoying life on your terms when you know that your financial assets will be handled with the care and respect that they deserve.